Welcome from our CEO

Welcome to As You Sow’s 2014 summer newsletter! In this edition, we cover our successes pushing ExxonMobil to report on climate risk and fracking, highlight Colgate’s commitment to recyclable packaging, showcase Responsible Sourcing Network’s Cotton Sourcing Snapshot, and profile shareholder advocate and As You Sow donor Maggie Kaplan.

We also spotlight our shareholder resolutions on GMOs, discuss our work with utilities on climate change, announce a new program and staff member, and present As You Sow’s 2013 Annual Report.

Thank you for your continued support of As You Sow as we make the protection of your health and the environment a central part of corporate decision making. Please feel free to share this with your networks and connect with us on Twitter, Facebook, or LinkedIn.

Click here to view the print version of this newsletter as a PDF.

Thank you for your support.

Best,

Andrew Behar, CEO

ExxonMobil Agrees to Disclose Climate Risk – But More is Needed

ExxonMobil refinery. Photo: commons.wikimedia.com

In response to As You Sow and Arjuna Capital’s shareholder resolution, ExxonMobil agreed for the first time ever to publish a Carbon Asset Risk report describing how it assesses the risk of stranded assets from climate change. This commitment was heralded in over 350 news stories and marked the first recognition by an oil company of the potential for stranded reserve assets due to increasingly stringent global warming regulations, reduced demand for oil, fuel switching, and competition from renewables.

Read our press release

World governments agree that if catastrophic warming over 2°C is to be avoided, 80% of proven fossil fuel reserves must remain unburned. These reserves, currently on the balance sheets of the 200 largest coal, oil, and gas companies, are valued at $20 trillion.

Shareholders asked whether Exxon is adequately preparing for a changing energy market. When Exxon issued the requested report, many investors expressed disappointment that Exxon is continuing business as usual in the face of global warming. The company stated that demand will continue to grow, and that major restrictions on the burning of carbon-based fuels are not likely.

Despite its business-as-usual response, the fact that the largest American oil and gas company is the first to acknowledge the issue of stranded assets sends a signal to Wall Street that there is more risk than was previously disclosed. Energy companies must acknowledge that preparing for a low-carbon future is a necessity, not a choice. Pouring capital into development of fossil fuel reserves in the face of increasingly destructive climate change is a damaging investment, placing shareowner capital at risk.

This was the first successful withdrawal with an oil and gas producer on the carbon asset risk issue this proxy season. As You Sow filed similar resolutions with Chevron, Anadarko, Hess, and CONSOL Energy.

Read more about our work on stranded carbon assets on our Carbon Bubble page.

Colgate To Phase out Unrecyclable Packaging

Enough Capri-Sun wrappers were discarded last year to cover California and Texas.

Our Waste program’s new focus on eliminating unrecyclable packaging is off to a great start with a major commitment from Colgate-Palmolive and a strong shareholder vote at Mondelez International.

After dialogue stemming from a 2012 shareholder resolution filed by As You Sow, Colgate committed to eliminate unrecyclable packaging for three of its four product categories by 2020. In addition, Colgate will work to develop a recyclable toothpaste tube. Toothpaste tubes made of plastic laminates currently cannot be recycled.

We are pressing companies on recyclability because of the enormous waste of resources represented by unrecyclable packaging, and because it’s more likely to be littered and swept into waterways. This contributes to the growing problem of plastic pollution in the world’s oceans which clogs waterways and damages marine ecosystems. Recent research indicates plastic particles absorb potent toxins from water or sediment and transfer them into the marine food web.

In 2014 we filed shareholder proposals on recyclability with Mondelez, Kraft Foods, General Mills, and Procter & Gamble. The first vote on this issue was a strong one of 28.4% at Mondelez, with shares worth $11.8 billion supporting our proposal. Mondelez, formerly part of Kraft Foods, is the world’s largest snack food company, producer of brands such as Oreo cookies, Ritz crackers and Philadelphia Cream Cheese. A related vote at Dr Pepper Snapple on bottle and can recycling goals got a solid 30% result.

Kraft and Mondelez use unrecyclable composite laminate/aluminum foil pouches, such as those used to package Kraft Capri-Sun juices, which pose another threat to the environment. There were enough Capri-Sun wrappers discarded in the U.S. alone last year to cover California and Texas. Our new video Designed to Be Waste shines a light on companies using unrecyclable packaging when better alternatives are available.

Read more about our work on unrecyclable packaging on our Consumer Packaging page.

How is the Apparel Industry Avoiding Slave-Harvested Cotton?

Responsible Sourcing Network’s Cotton Sourcing Snapshot surveys company practices to end forced labor in their supply chains.

Cotton Sourcing Snapshot, a new report from As You Sow’s Responsible Sourcing Network (RSN), rates 49 apparel and home goods companies on their efforts to prevent cotton from Uzbekistan picked with forced adult and child labor from entering their supply chains.

The Government of Uzbekistan is notorious for forcing up to a million of its citizens to work in the cotton harvest each year. Due to mounting international pressure, the last two harvests have largely excluded children ages 6-15. However, the Uzbek government is now mobilizing even greater numbers of teens and adults.

Companies were assessed by answering a survey, which offered a maximum of 100 points across four categories. Only five companies scored over 50 points, including adidas, IKEA, and Patagonia. Nineteen scored under 25 points, and two companies, Urban Outfitters and All Saints, scored none at all.

While nearly 80% of companies have some sort of policy against Uzbek cotton, about the same amount do not audit their yarn spinners or textile mills, which can expose brands to risk. RSN is planning to address this risk in the coming year by launching the Spinner Verification Initiative.

The report offers several recommendations to help move companies toward greater certainty of cotton sourcing. These include participating in an industry-wide spinner verification program, integrating supplier compliance into IT systems, and increasing disclosure of internal practices.

Read more about RSN’s work on cotton from Uzbekistan at sourcingnetwork.org.

Abbott Shareholders Call for Action on GMOs

GMO crops can lead to increased pesticide use, crop blights, and risks to public health. Photo: Flickr/Reinhold Stansich

Shareholders sent a strong message to Abbott Laboratories over concerns about the use of genetically modified organisms (GMOs) in the company’s Similac baby formula. A second-year resolution filed by As You Sow in favor of GMO labeling earned the support of 6.7% of shareholders, representing $2.2 billion in shares.

The vote reflects increasing investor worries about the potential risk of GMO ingredients. Peer-reviewed scientific research has demonstrated that GMO crops can lead to increased pesticide use, crop blights, and risks to public health. GMOs are labeled or banned in 64 countries. Recently, Vermont passed a comprehensive GMO labeling law, and several other U.S. states have GMO labeling ballot initiatives scheduled for upcoming elections.

Earlier this year, pressure from As You Sow and other concerned parties helped achieve a significant food safety victory when General Mills agreed to reformulate its original Cheerios cereal to be completely GMO-free. But there is still a long way to go as other General Mills cereals will continue to contain GMOs. We have filed another resolution with General Mills urging them to continue phasing out GMOs from their products until and unless long-term testing proves them safe.

With polls showing 93% of Americans in favor, GMO labeling in the United States is inevitable. Refusing to remove or label GMOs is a material risk to brand reputation, as companies are essentially telling consumers they don’t deserve to know what’s in their food. We will continue working with shareholders and advocates to make 2014 a breakthrough year for health and safety in food.

Read more about our work on GMOs on our GMO page.

Utilities Come to the Table on Climate Change

Big box stores and other large energy consumers are increasingly turning to solar power. Photo: minneapolismn.gov

Thanks to shareholder proposals filed by As You Sow, two of America’s largest utilities have agreed to report on their plans for a low-carbon future.

This spring, both Southern Company and FirstEnergy agreed to report on C02 reduction strategies. FirstEnergy pledged to examine various CO2 reduction strategies, review the age and lifespan of its existing fossil fleet, and research how increased standards of performance and environmental regulation will affect the company. Southern Company followed FirstEnergy’s lead by announcing it would publish a report on its renewable energy investments. The report details both current sources of renewable energy and projects expected to come online by 2015.

With new pollution rules from the EPA making it costly to open new coal plants, and with old plants being closed across the nation, utilities are recognizing coal as a financial risk. The consensus among industry analysts is that nearly half of U.S. coal-burning plants are over 40 years old and could be retired in the very near future.

Between extensive coal plant closures and the rapid adoption of solar, utilities are in a quandary. Utilities’ highest value customers, such as large box stores, are replacing utility services by installing their own solar panels to lock in long term fixed rates. This trend has caught Wall Street’s attention. Barclays recently downgraded the corporate debt for all U.S. utilities from “market weight” to “underweight”, stating that they believe that solar “…could reconfigure the organization and regulation of the electric power business over the coming decade.”

These negotiated withdrawals indicate that utilities are increasingly aware they need to change. Companies which aggressively adopt climate-friendly power are some of the most profitable and admired in the sector. It’s time for utilities to build a better business model.

Read more about our work with coal-burning utilities on our Coal page.

Exxon Agrees to Address Fracking Risks

Fracking operations have long been known to cause harm, including spills, industrial accidents, and harmful air and water pollution.

Photo: lacounty.gov

Just weeks after ExxonMobil agreed to report on its risk of stranded carbon assets, the oil and gas giant announced that it will begin providing increased transparency and information about its hydraulic fracturing operations. For five years, As You Sow has filed a shareholder proposal requesting adoption of best management practices and reporting on its progress in reducing impacts to communities and the environment. The company finally agreed to provide much of the information we requested and, importantly, to work with us to provide additional quantitative data about success in reducing impacts in the future. As You Sow filed the shareholder proposal in conjunction with New York City Pension Funds and 12 co-filers.

Fracking operations have long been known to cause harm, including spills, industrial accidents, and harmful air and water pollution. Exxon ranked as one of the lowest-scoring of the 24 companies surveyed in Disclosing the Facts, a 2013 report by As You Sow, Boston Common, Green Century, and IEHN. Exxon earned only two points out of a possible 32. In exchange for withdrawal of the shareholder resolution Exxon agreed to respond to 26 key indicators analyzed in the report.

We believe that companies that disclose risk and address shareholder concerns openly will perform better than those that lack transparency. The risks of fracking are real to communities directly affected as well as to shareholders. That Exxon has agreed to address these risks is encouraging. Shareholders will be better able to assess whether the company is adopting effective policies to avoid or eliminate the harms associated with fracking and shale gas extraction operations.

This year, As You Sow also filed shareholder resolutions on fracking risks with Chevron and Occidental Petroleum.

Read more on our Hydraulic Fracturing page.

Rosanna Landis Weaver To Lead New Executive Compensation Program

Rosanna Landis Weaver, Manager of As You Sow’s new Power of the Proxy: Executive Compensation Program.

Rosanna Landis Weaver has been named Manager of a new Power of the Proxy: Executive Compensation Program that will focus on pay equity at public companies.

“The goal of this program is to work with large shareholders to fully use the power of their proxy vote to bring about fundamental change to reduce unjustified CEO pay and to create greater equity in compensation,” said Andrew Behar, CEO of As You Sow. “Weaver brings to the position a deep knowledge of executive compensation, shareholder activism, and the regulatory environment, as well as the passion of an activist.”

A former senior analyst on the executive compensation team at Institutional Shareholder Services (ISS), Weaver served most recently as Governance Research Coordinator at Change to Win (CtW) Investment Group. Her governance career began over 20 years ago at the Corporate Affairs office at the International Brotherhood of Teamsters, where she drafted shareholder resolutions on a range of issues, including option repricing.

“There is an increasing understanding of the destructive role that runaway executive compensation plays in society,” commented Weaver. “Poorly designed compensation plans are bad for shareholders as a whole but also for individual companies. It is time for a unified focus on this important issue.”

Shareholder Advocate and Donor Profile – Maggie Kaplan

Maggie Kaplan, Founder and Executive Director of Invoking the Pause, shareholder advocate and As You Sow donor.

Though I’ve been a social activist for many years, shareholder advocacy is a new arena for me. As the Founder and Executive Director of Invoking the Pause, an environmental grants program, I’ve worked to advance public awareness and engagement about climate change issues for years. We have used our funds to give artists and activists the ‘pause’ they need to complete their worthy work. I am a retired corporate lawyer, and have always believed that corporations have responsibility for their impact on the world and the environment. But before I was introduced to As You Sow, I didn’t completely realize how much power I had as a shareholder to affect the companies I own.

Since meeting As You Sow CEO Andrew Behar last year, we have worked together to file a resolution on beverage container recycling at Dr Pepper Snapple Group. In addition, Invoking the Pause’s partnership with the Presidio Graduate School of Sustainability in San Francisco led me to fund a Fellowship for a graduate student currently working on As You Sow’s upcoming survey of recyclable packaging at fast food, beverage, and packaged food companies. Though I’ve traditionally worked on climate issues, I know that unrecyclable packaging is a tremendous waste of energy and creates unnecessary emissions. As John Muir said, “When one tugs at a single thing in nature, he finds it attached to the rest of the world.”

Getting involved with As You Sow’s shareholder advocacy has introduced me to a new way I can create positive change. I ask myself, how can I best work to create a world that reflects beauty, harmony in nature, and harmony among beings? For me, it is using my time, talent, and financial resources to engage in environmental activism. I’m looking forward to partnering with As You Sow again, and continuing to use my power as a shareholder to get companies to behave more responsibly and sustainably.

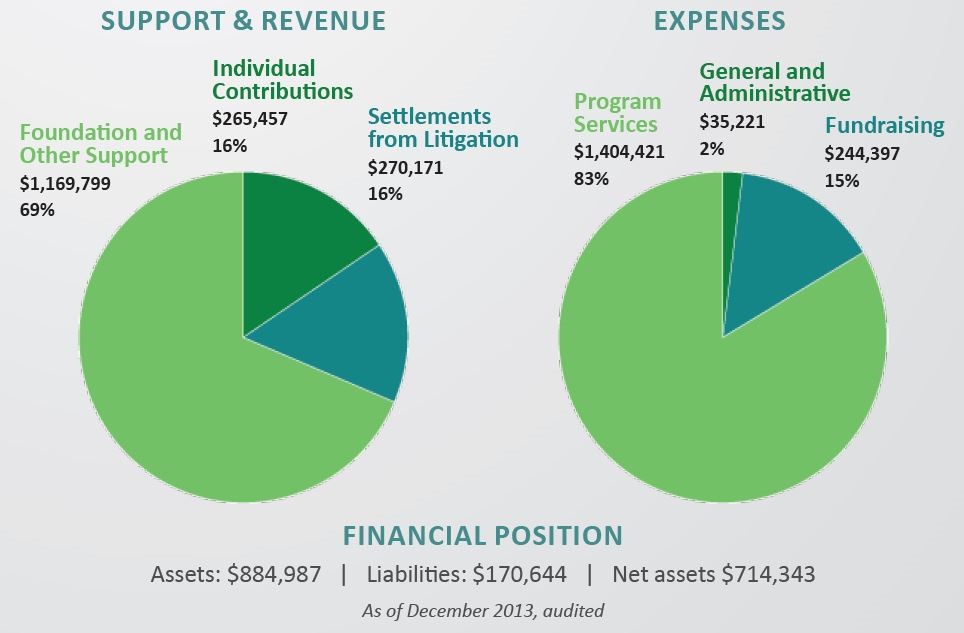

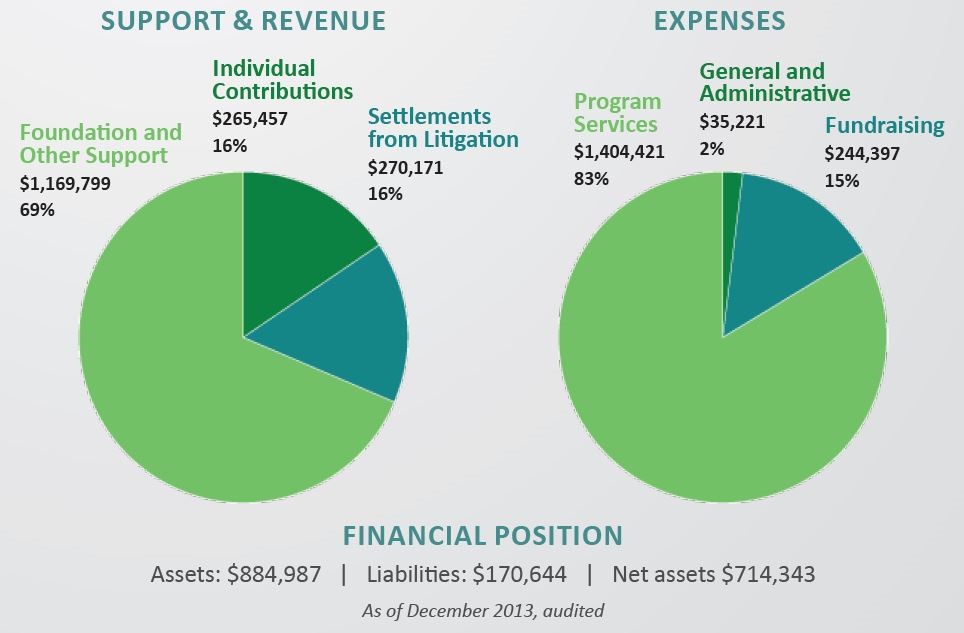

2013 Annual Report

In 2013, As You Sow engaged dozens of companies, including filing 15 shareholder resolutions, asking for increased responsibility on environmental and social issues by corporate boards and management. Some highlights of our program accomplishments are listed below:

Energy

- Our resolutions asking Exxon and Chevron to report on the risks of hydraulic fracturing were both supported by over 30% of voting shares at the companies’ annual meetings.

- Our resolution at CONSOL Energy on carbon asset risk, the first of its kind to go to a vote, was supported by nearly 20% of voting shares.

- We released Cleantech Redefined, a report examining the latest investment opportunities and trends across the cleantech sector.

- We released Disclosing the Facts, a scorecard report benchmarking gas companies’ transparency about their hydraulic fracturing practices, in collaboration with Boston Common Asset Management, Green Century, and the Investor Environmental Health Network.

- We negotiated a withdrawal of our shareholder resolution at Ameren in exchange for the company’s commitment to adopt a water policy and improve disclosure around water use and impacts on waterways.

Environmental Health

- Whole Foods Market announced that it will label all GMO foods in its stores by 2018 following dialogues with As You Sow.

- We organized a coalition of investors to urge companies not to oppose GMO-related ballot initiatives. Consequently, 14 of the top 50 donors opposing a California GMO initiative in 2012 did not spend funds to oppose a Washington initiative in 2013.

- We released Slipping Through the Cracks: An Issue Brief on Nanomaterials in Foods, and began engaging the food industry to prevent the use of potentially unsafe nanomaterials. Our nanomaterial food testing project raised over $6,000 to test M&Ms and Pop-Tarts. Nanomaterials were found in both products.

- Our Toxic Enforcement Division settled seven Proposition 65 cases for failure to warn of reproductive and carcinogenic chemicals in a range of consumer products. Our work led to product reformulations and placement of consumer warnings.

Waste

- McDonald’s agreed to replace foam hot beverage cups with paper cups at all 14,000 U.S. restaurants and select foreign markets following a shareholder vote and dialogue. Dunkin’ Donuts agreed on a timeline to phase out foam coffee cups, but has not yet decided on alternative materials.

- Proposals asking Amazon and Walmart to take back electronic waste were withdrawn after both companies agreed to a series of substantive dialogue meetings.

- We pressed brands to make all packaging recyclable, using plastic pouches as a symbol of wasted resources and spotlighting evidence of toxicity in ocean plastic. This led to a first-of-its-kind commitment by Colgate-Palmolive to phase out non-recyclable packaging by 2020.

Human Rights

- Responsible Sourcing Network (RSN), a project of As You Sow, co-authored Expectations for Companies’ Conflict Mineral Reporting, a white paper producted with Enough Project designed to give companies guidance for their Dodd-Frank conflict minerals submissions to the Securities and Exchange Commission.

- New signatories to our Pledge against Forced Child and Adult Labor in Uzbek Cotton included Ikea, lululemon, and Marks and Spencer, which helped surpass a total market capitalization of $1 trillion for pledge supporters.

- During the 2013 harvest, the Government of Uzbekistan almost entirely eliminated children under the age of 16 from the cotton fields. We are now focused on eliminating similar forced labor for adults.