To Spur Employee Innovation and Engagement

As millennial-aged employees now represent the majority of the U.S. workforce, it is increasingly important that corporate management finds ways to engage them in the company. Creating defined contribution plans which connect to their core values – like solving human, social and environmental problems through their work and investments – can spur employee engagement and spark innovation.

Furthermore, adding ESG funds to an organization’s employee contribution plan enables a corporation to align its stated climate, environmental, social, and other sustainability policies, including adoption of U.N.  Sustainable Development Goals (SDGs), and the U.N. Principles of Responsible Investing (UNPRI) with its investment options. The oft-heard phrase, “put your money where your mouth is” has never been truer or easier to implement.

Sustainable Development Goals (SDGs), and the U.N. Principles of Responsible Investing (UNPRI) with its investment options. The oft-heard phrase, “put your money where your mouth is” has never been truer or easier to implement.

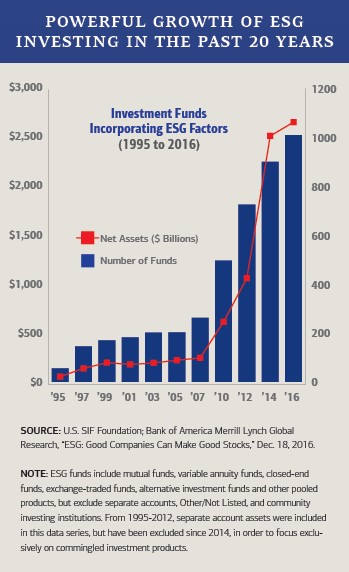

Between 2012 and 2016 the market for mutual funds and exchange traded funds (ETFs) with an Environmental, Social, or Governance (ESG) focus has increased $4.98 trillion, up to $8.72 trillion, a growth of over 133%.[i] The benefits of including ESG considerations in investment decisions have become more widely understood and the market has responded by increasing investments in funds that include these concerns in their prospectus and holdings. In addition to the potential financial upside of ESG investments, a growing number of investors are moving to ESG-oriented funds as a way to reduce risk and incorporate their values in their investment decisions. This is largely driven by the increasing proportion of millennials in the workforce. A whopping 85% of millennials surveyed in the 2016 U.S. Trust study, “Insights on Wealth and Worth,” said they consider their investment decisions as “a way to express their social, political, and environmental values.”[ii]

Despite the growth of ESG-oriented funds in the wider investment market, the $8.4 trillion in U.S. corporate defined contribution plans (including 401(k), 403(b), and IRAs) do not reflect this growth and in fact have barely begun to include ESG funds in their portfolios.[iii] As an example, Vanguard reported that only 9% of its employee plans included ESG funds, most of which offered only a single fund rather than a suite of offerings.[iv] This discrepancy provides a tremendous opportunity for corporate plan administrators to align corporate values and sustainability goals with investments, while simultaneously enticing new employees, retaining existing ones, and increasing participation and contributions through a simple change in policy.

A recent 2015 Department of Labor ERISA guidance document indicates that considering ESG issues when making investments is not only allowed as part of a fiduciaries’ consideration, but where such issues may directly affect the economic value of an investment, fiduciaries should appropriately consider such factors.

This white paper highlights case studies and recent investing trends demonstrating the benefits of incorporating ESG options into corporate defined contribution plans. It shows that those corporations providing a greater array of ESG mutual funds and exchange traded funds (ETFs) in their plans will benefit from overall corporate coherence of policy and practice and facilitate a shift in corporate culture to respect and amplify employee values. This leads to material benefits for both the company and the employees, is relatively simple to implement once an executive decision is made to make such an adjustment, and is most successful when employees are part of the process from the beginning and through implementation.